Iowa Property Tax Payment History . access reports on replacement excise taxes owed to the various local government tax levying. property taxes are paid twice a year in september and march to local county treasurers. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa income tax. (back to top) property tax payments are due in two installments. The 1 st installment is due. It begins with the assessor determining the. the property tax cycle in iowa takes a total of eighteen months from start to finish. when are my taxes due? annual tax statements are mailed once a year. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. Your property tax payment may be paid in one full installment or two half installments.

from www.formsbank.com

It begins with the assessor determining the. when are my taxes due? Your property tax payment may be paid in one full installment or two half installments. property taxes are paid twice a year in september and march to local county treasurers. access reports on replacement excise taxes owed to the various local government tax levying. The 1 st installment is due. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa income tax. the property tax cycle in iowa takes a total of eighteen months from start to finish. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. annual tax statements are mailed once a year.

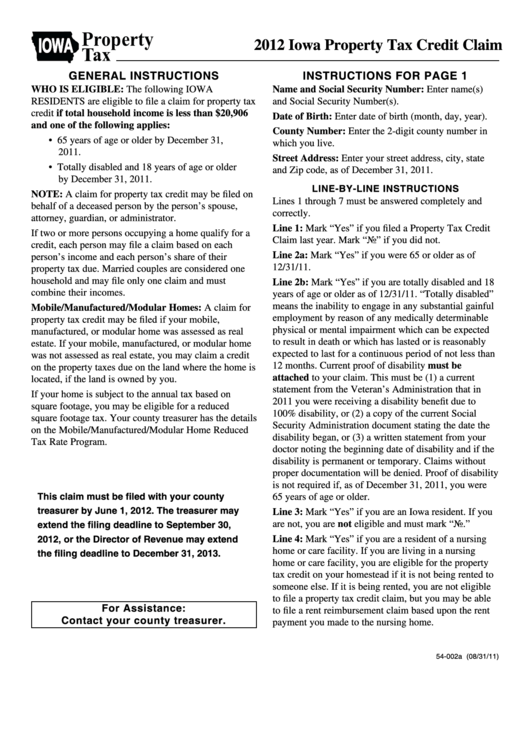

Instructions For Form 54002 Iowa Property Tax Credit Claim 2012

Iowa Property Tax Payment History The 1 st installment is due. (back to top) property tax payments are due in two installments. access reports on replacement excise taxes owed to the various local government tax levying. the property tax cycle in iowa takes a total of eighteen months from start to finish. The 1 st installment is due. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa income tax. annual tax statements are mailed once a year. when are my taxes due? property taxes are paid twice a year in september and march to local county treasurers. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. Your property tax payment may be paid in one full installment or two half installments. It begins with the assessor determining the.

From iowaleague.org

Property Tax Information and Resources IOWA League Iowa Property Tax Payment History property taxes are paid twice a year in september and march to local county treasurers. when are my taxes due? the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. access reports on replacement excise taxes owed to the various local government tax levying. Your property tax. Iowa Property Tax Payment History.

From www.co.carver.mn.us

Timeline for Property Taxes Carver County, MN Iowa Property Tax Payment History (back to top) property tax payments are due in two installments. annual tax statements are mailed once a year. access reports on replacement excise taxes owed to the various local government tax levying. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa. Iowa Property Tax Payment History.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator Iowa Property Tax Payment History annual tax statements are mailed once a year. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. property taxes are paid twice a year in september and march to local county treasurers. It begins with the assessor determining the. Your property tax payment may be paid in. Iowa Property Tax Payment History.

From caffeinatedthoughts.com

Iowa’s Business Property Taxes Highest in Nation Caffeinated Thoughts Iowa Property Tax Payment History the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. access reports on replacement excise taxes owed to the various local government tax levying. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa. Iowa Property Tax Payment History.

From iowacapitaldispatch.com

As assessed values soar, House committee advances amended property tax Iowa Property Tax Payment History Your property tax payment may be paid in one full installment or two half installments. It begins with the assessor determining the. (back to top) property tax payments are due in two installments. access reports on replacement excise taxes owed to the various local government tax levying. property taxes are paid twice a year in september and march. Iowa Property Tax Payment History.

From www.iowataxandtags.org

Home Iowa Tax And Tags Iowa Property Tax Payment History property taxes are paid twice a year in september and march to local county treasurers. annual tax statements are mailed once a year. (back to top) property tax payments are due in two installments. The 1 st installment is due. when are my taxes due? if you received income from an iowa property that you own. Iowa Property Tax Payment History.

From www.loc.gov

Map of Mahaska County, Iowa, 1895. Library of Congress Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. It begins with the assessor determining the. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa income tax. property taxes are paid twice a year in september and. Iowa Property Tax Payment History.

From www.formsbank.com

Instructions For Form 54002 Iowa Property Tax Credit Claim 2012 Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. property taxes are paid twice a year in september and march to local county treasurers. annual tax statements are mailed once a year. It begins with the assessor determining the. Your property tax payment may be paid in one full installment or two. Iowa Property Tax Payment History.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator Iowa Property Tax Payment History Your property tax payment may be paid in one full installment or two half installments. annual tax statements are mailed once a year. if you received income from an iowa property that you own and if you are a nonresident of iowa, you may have an iowa income tax. the johnson county treasurer’s office collects/distributes property tax,. Iowa Property Tax Payment History.

From itrfoundation.org

Consolidation of Property Tax Levies ITR Foundation Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. Your property tax payment may be paid in one full installment or two half installments. property taxes are paid twice a year in september and march to local county treasurers. (back to top) property tax payments are due in two installments. the johnson. Iowa Property Tax Payment History.

From jarodrickman.blogspot.com

iowa property tax calculator Jarod Rickman Iowa Property Tax Payment History annual tax statements are mailed once a year. It begins with the assessor determining the. when are my taxes due? Your property tax payment may be paid in one full installment or two half installments. property taxes are paid twice a year in september and march to local county treasurers. The 1 st installment is due. (back. Iowa Property Tax Payment History.

From itrfoundation.org

A Needed Reform for Iowa’s Property Taxpayers ITR Foundation Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. property taxes are paid twice a year in september and march to local county treasurers. when are my taxes due? the property tax cycle in iowa takes a total of eighteen months from start to finish. (back to top) property tax payments. Iowa Property Tax Payment History.

From exozqzefc.blob.core.windows.net

Johnson County Iowa Property Tax Payment at Patsy Meisner blog Iowa Property Tax Payment History the property tax cycle in iowa takes a total of eighteen months from start to finish. when are my taxes due? the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. if you received income from an iowa property that you own and if you are a. Iowa Property Tax Payment History.

From itrfoundation.org

Time to Solve Iowa’s Property Tax Problem ITR Foundation Iowa Property Tax Payment History the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. (back to top) property tax payments are due in two installments. access reports on replacement excise taxes owed to the various local government tax levying. annual tax statements are mailed once a year. The 1 st installment is. Iowa Property Tax Payment History.

From nicholasmitchell.pages.dev

When Are Iowa State Taxes Due 2025 Nicholas Mitchell Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. property taxes are paid twice a year in september and march to local county treasurers. annual tax statements are mailed once a year. the property tax cycle in iowa takes a total of eighteen months from start to finish. The 1 st. Iowa Property Tax Payment History.

From kayleahailie.blogspot.com

20+ Iowa Property Tax Calculator KayleaHailie Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. Your property tax payment may be paid in one full installment or two half installments. The 1 st installment is due. (back to top) property tax payments are due in two installments. annual tax statements are mailed once a year. the johnson county. Iowa Property Tax Payment History.

From www.blackhawkcounty.iowa.gov

Payment Options for Property Taxes Black Hawk County IA Iowa Property Tax Payment History when are my taxes due? Your property tax payment may be paid in one full installment or two half installments. The 1 st installment is due. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. annual tax statements are mailed once a year. property taxes are. Iowa Property Tax Payment History.

From goldibraquel.pages.dev

Iowa Estimated Tax Payments 2024 Due Dates Emlyn Gwenora Iowa Property Tax Payment History access reports on replacement excise taxes owed to the various local government tax levying. the johnson county treasurer’s office collects/distributes property tax, maintains accounts, conducts tax sales, and is home to the motor. (back to top) property tax payments are due in two installments. Your property tax payment may be paid in one full installment or two half. Iowa Property Tax Payment History.